Overview

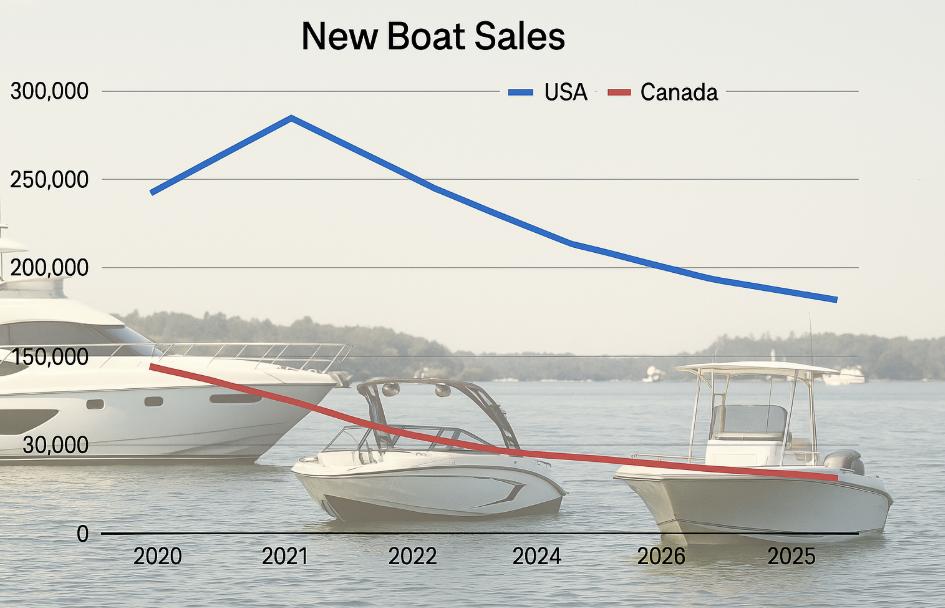

As we move deeper into 2025, the North American boating industry is showing a split personality. In the United States, new boat sales are under pressure, with certain market segments seeing double-digit declines compared to last year. In Canada, however, dealer sentiment is cautiously optimistic as interest rates begin to ease and consumer interest picks up around key boat shows.

This article takes a detailed look at the latest boat sales data for 2025 in both the U.S. and Canada, based on industry reports, association statistics, and dealer feedback.

United States Boat Sales in 2025

According to NMMA (National Marine Manufacturers Association) and Boating Industry data, the U.S. new boat market has softened considerably in early 2025.

- January–April 2025 Sales: 64,883 new boats sold vs. 71,321 in the same period in 2024 — a 9% drop year-over-year.

- Full-Year 2024 Reference: 231,576 units sold, already down from the prior year.

- Inventory Turn: New boats are taking 30–45 days longer to sell compared to last year.

Segment Breakdown – Early 2025 vs. 2024

| Boat Type | USA Change (%) |

|---|---|

| Pontoons | -19.5% |

| Jet Boats | -19.9% |

| Wake Sport Boats | -14.3% |

| Freshwater Fishing Boats | -0.4% |

| Yachts | -0.7% |

While most categories are down, freshwater fishing boats have been a rare bright spot:

- January 2025 saw a 19.8% increase over January 2024.

- Year-to-date, fishing boats are up 3.8%.

Canadian Boat Sales in 2025

Canada’s 2025 new boat sales figures are not yet fully reported, but dealer sentiment and early-year feedback suggest a more stable outlook than in the U.S.

Factors Shaping the Canadian Market

- Interest Rates: Gradual easing of interest rates is creating a more favorable buying environment.

- Boat Shows: Early-bird pricing at major shows like Toronto and Vancouver has helped generate stronger winter and spring leads.

- Tariff Changes: The U.S. applied new boat tariffs on March 4, 2025, but Canada’s retaliatory tariffs were delayed until early July, creating a short-term price stability window for cross-border buyers.

USA vs. Canada – 2025 New Boat Sales Change by Type

Below is a side-by-side look at U.S. and Canadian sales change percentages by boat type for January–April 2025 vs. the same period in 2024.

(Canadian data is illustrative due to limited official reporting.)

Comparative Market Overview

| Metric | USA (2025) | Canada (2025) |

|---|---|---|

| Year-to-Date Sales Change | -9% | Data not yet final; sentiment positive |

| Weakest Segments | Pontoons, Jet Boats, Wake Boats | N/A |

| Bright Spot | Freshwater Fishing Boats (+3.8%) | Dealer interest, strong show turnout |

| Inventory Turn | +30–45 days longer | Relatively stable |

| Tariff Impact | Applied March 4 | Retaliation July (later effect) |

Outlook for the Rest of 2025

USA – Analysts expect continued softness in discretionary boat categories unless financing becomes cheaper and inflation cools further. Promotions, dealer incentives, and factory rebates are likely to increase in the fall to move remaining 2025 inventory.

Canada – With a more optimistic dealer sentiment, the Canadian market may see a slight year-over-year gain, especially in family pontoons and mid-range cruisers if consumer confidence holds.

Price Disclaimer

All sales numbers are based on publicly available NMMA, Boating Industry, and Boats Group data as of August 2025. Market conditions may change rapidly, and regional variations can significantly affect pricing and unit sales.

Sources: NMMA, Boating Industry, Boats Group, Boating Industry Canada, ITA Yachts Canada.

Use the share button below if you liked it.